Samsung’s Bold Move Into the Invisible Economy

When your data center goes down, it’s not the servers that failed—it was the air. When a hospital loses power during surgery, it wasn’t the electricity that mattered most—it was the climate control. Yet the HVAC industry remains one of the most overlooked, unglamorous sectors in global infrastructure. Samsung just changed that calculation entirely.

On November 12, 2025, Samsung Electronics completed its acquisition of FläktGroup, Europe’s largest HVAC company, signaling something profound: the next competitive frontier isn’t about what you compute, it’s about what keeps your computation alive. This isn’t just another acquisition. It’s a strategic confession that in an AI-driven world, cooling systems are the new currency of innovation.

The Unsexy Truth About Tomorrow’s Economy

Let’s be direct: nobody dreams of HVAC. But every revolutionary technology—from quantum computing to AI training—dreams of HVAC engineers.

Here’s what changed: A decade ago, HVAC was a commodity. You bought it, installed it, forgot about it. But the explosion of AI data centers transformed this calculus overnight. A single large-scale AI training facility can consume as much electricity as a small city. And electricity becomes useless without precision climate control.

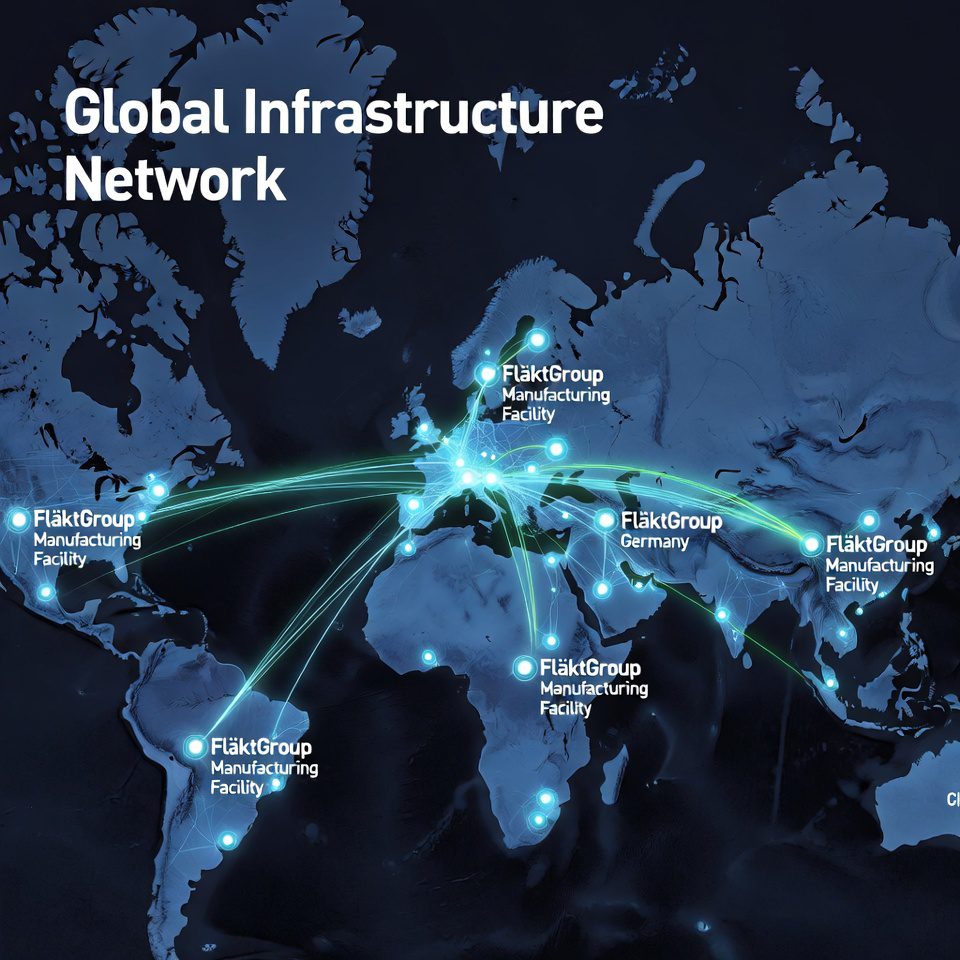

Consider the numbers: A hyperscale data center can generate 10-15 megawatts of heat simultaneously. Traditional HVAC systems designed for office buildings or factories simply cannot manage this thermal density. You need precision engineering that operates at the intersection of physics, thermodynamics, and computational optimization. FläktGroup, with over a century of technical expertise and more than 10 production facilities across global markets, represents something Samsung recognized that others missed: control over thermal infrastructure is control over the future of technology itself.

The company already powers precision cooling for hyperscale customers and participated in the Stargate Project—the joint venture between OpenAI and SoftBank aiming to build the AI infrastructure backbone of the next decade. This isn’t peripheral expertise. This is foundational.

Samsung’s Invisible Chessboard: Four Strategic Moves Reshaping the Industry

Supply Chain as Strategy, Not Logistics

Samsung announced it would “expand R&D and strengthen the supply chain” through FläktGroup’s global network. This translation masks something far more significant: Samsung is building regional fortress positions that competitors cannot easily replicate.

Why this matters at scale:

Traditional supply chain thinking treats manufacturing as a cost center—locate it where labor is cheap, shipping is fast. But HVAC infrastructure has brutal geography constraints that make this impossible. You cannot airfreight a central cooling system. You cannot substitute a thermal management system designed for European climates into Asian data centers without fundamental redesign. You need:

Local engineering expertise that understands regional climate variations

Local manufacturing capacity for rapid deployment and customization

Local service networks capable of 24/7 emergency response

Local regulatory knowledge across different emissions, safety, and energy standards

FläktGroup provides exactly this across multiple continents simultaneously. In Europe, it operates established production bases serving the continent’s stringent energy efficiency regulations (EU Energy Related Products Directive). In North America, it maintains facilities aligned with ASHRAE standards and varying state-level environmental codes. In Asia, it has built relationships with local partners understanding the unique thermal challenges of tropical climates and monsoon seasons.

The competitive advantage: When a hyperscale data center operator in Singapore needs emergency thermal system repair at 2 AM, they don’t wait for parts from Europe or America. They call a local technician who understands their facility’s specific architecture because FläktGroup has been operating in that region for decades. Samsung now owns that relationship, that knowledge, that speed.

This is supply chain thinking elevated to strategic infrastructure control. It’s not about optimization—it’s about indispensability.

The Intelligence Layer: Where Hardware Becomes Adaptive

Here’s where this acquisition transcends mechanical engineering entirely. Samsung plans to integrate FläktGroup’s advanced control systems with its building management platforms—SmartThings Pro and b.IoT.

What this means in practice:

Imagine HVAC systems that don’t just cool—they anticipate and learn. Traditional systems operate reactively: temperature rises, cooling increases. FläktGroup’s integrated systems with Samsung’s AI platforms operate predictively: the system analyzes incoming thermal loads, predicts spikes minutes or hours in advance, and pre-positions cooling capacity.

In a data center, this translates to:

Predictive thermal load management: Machine learning models trained on historical data patterns predict when GPU clusters will generate maximum heat based on scheduled workloads, allowing cooling systems to prepare in advance

Real-time efficiency optimization: AI algorithms continuously adjust cooling tower speeds, liquid cooling circulation, and hot/cold aisle containment based on actual thermal signatures across thousands of sensors

Energy consumption optimization: Rather than maintaining constant cooling capacity, systems dynamically modulate to match actual demand, potentially reducing energy consumption by 20-30%

Cross-system communication: Thermal data feeds directly into facility management, power distribution, workload scheduling, and even billing systems

This transforms FläktGroup’s expertise from mechanical engineering into distributed intelligence infrastructure—exactly where Samsung’s AI platforms thrive.

Industrial applications beyond data centers:

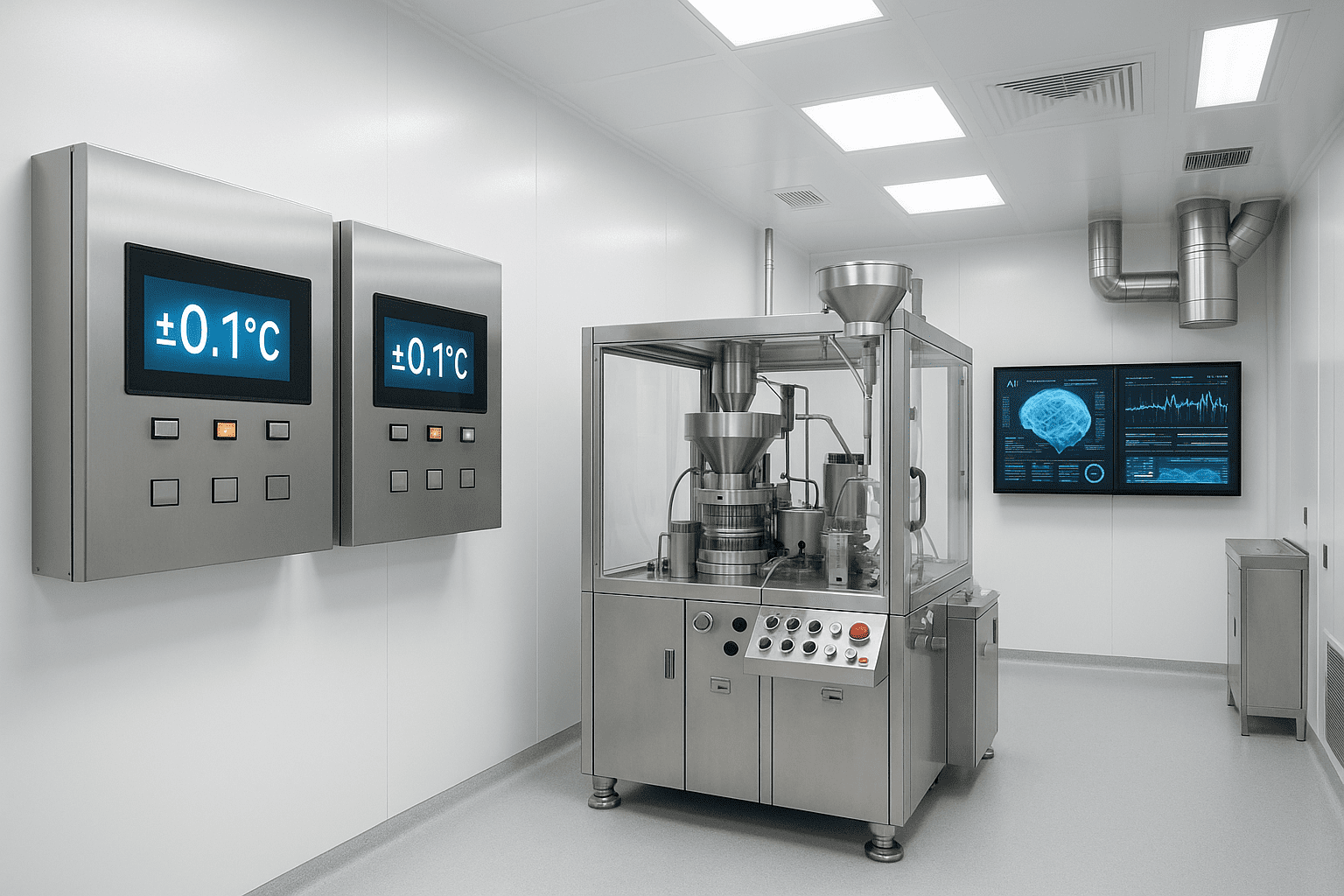

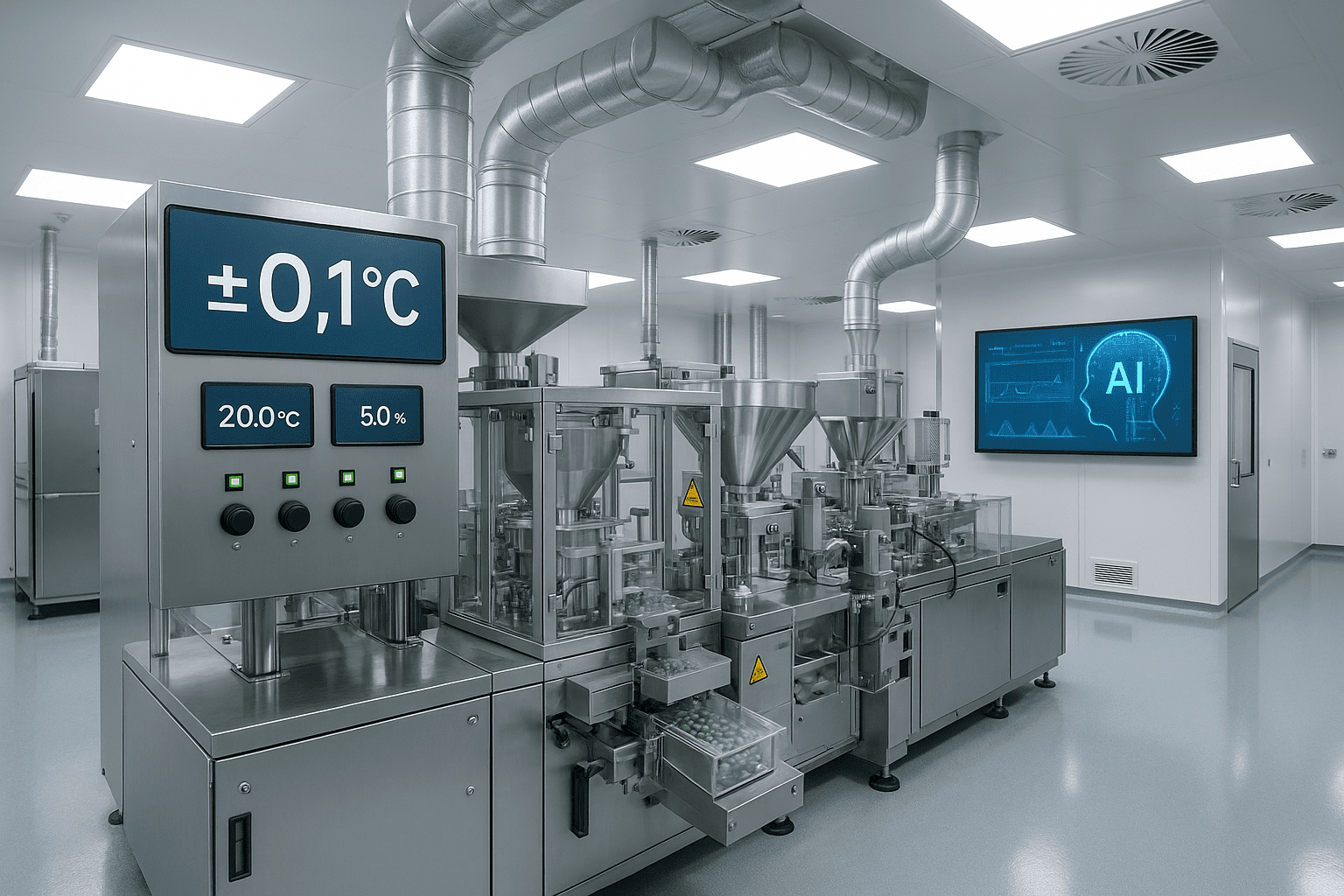

Pharmaceutical manufacturing requires temperature precision within ±0.5°C across massive clean rooms. Precision cooling with AI optimization can maintain these tolerances while reducing energy costs by 15-20%. Semiconductor fabrication faces similar challenges—modern chip production requires clean rooms maintained at precise temperatures and humidity levels. Any deviation can ruin millions of dollars worth of product in process.

With AI-optimized systems, Samsung now offers pharmaceutical and semiconductor manufacturers not just cooling, but thermal intelligence—systems that learn their specific production patterns and optimize accordingly.

The Lennox Gambit: Dual Pathways, Maximum Optionality

Samsung formed a joint venture with Lennox International last year. Combined with the FläktGroup acquisition, Samsung now has dual pathways into North America: one through partnership, one through ownership.

To the untrained eye, this seems redundant. Why operate both?

The strategic genius lies in segmentation:

Lennox excels in residential and light commercial markets. Homeowners, small office buildings, regional chains. This is Lennox’s core strength—high volume, standardized products, efficient distribution.

FläktGroup dominates industrial, commercial, and hyperscale markets. Large factories, data centers, pharmaceutical facilities, hospitals. This is engineered solutions territory—high complexity, high customization, high value per unit.

These markets have almost no overlap. The sales channels differ. The engineering requirements differ. The customer relationships differ. The regulatory environments differ.

By maintaining both partnerships and ownership, Samsung doesn’t have to choose. It can:

Deploy Lennox products for mass-market segments and residential HVAC needs

Deploy FläktGroup solutions for industrial and hyperscale applications

Cross-train technical teams between the two companies

Create integration points between residential IoT (SmartThings) and industrial systems (b.IoT)

Offer customers a complete thermal ecosystem from home to data center

The competitive moat: A competitor acquiring either Lennox or FläktGroup gets one market segment. Samsung owns both, creating an ecosystem lock-in effect. A business owner considering a new facility might start with Samsung residential HVAC for site offices, then expand to commercial systems for the main building, then partner on industrial cooling for manufacturing. Each decision reinforces the next.

This isn’t just strategic partnership—it’s ecosystem capture through optionality.

Data Centers as the Marquee Customer, But Not the Only One

The real story hiding in this acquisition: Samsung is positioning itself as the essential infrastructure provider for the AI boom, but this is a Trojan horse for something broader.

With dedicated data center teams in North America and a global account team headquartered in Singapore, FläktGroup already serves hyperscale customers. Samsung now inherits these relationships and can bundle them into larger ecosystem plays. But the genius is that these relationships extend beyond data centers:

The hidden diversification:

- Hyperscale hospitality: Luxury hotel chains require massive HVAC systems for thousands of guest rooms, restaurants, convention spaces, kitchen facilities. They’re demanding energy efficiency and smart integration. FläktGroup serves them. Samsung now does too.

- Healthcare transformation: Post-COVID, hospitals globally are upgrading HVAC systems to meet advanced air filtration, separate contamination zones, and redundancy requirements. The hospital market is worth tens of billions annually and largely underserved by integrated smart solutions.

- Pharmaceutical and biotech expansion: mRNA vaccine production, biopharmaceutical manufacturing, and advanced research facilities all require precision cooling at hyperscale. This market is growing 12-15% annually and commands premium pricing. Samsung can now offer integrated thermal + pharmaceutical facility optimization.

- Marine and industrial: FläktGroup supplies ventilation and climate control for large container ships, oil platforms, and industrial manufacturing. These sectors face unprecedented pressure to reduce fuel consumption and carbon emissions. Smart HVAC optimization directly addresses this.

- Food and beverage production: Large-scale food manufacturing requires climate control for preservation, processing, and storage. Energy costs are enormous. Smart thermal optimization is highly valuable.

The unspoken strategy: Yes, Samsung is betting on data center dominance in the AI era. But by acquiring FläktGroup, it’s also acquiring sophisticated relationships across industries that desperately need what it now offers: intelligent thermal infrastructure as a competitive advantage.

This transforms Samsung from a technology company dabbling in HVAC into an essential infrastructure partner across multiple industries.

The Industrial Ecosystem Transformation: How This Reshapes Manufacturing Globally

From Efficiency to Competitiveness

For the past two decades, industrial energy efficiency was primarily a compliance issue. Regulations mandated certain efficiency standards. Companies met them. Done.

Samsung’s acquisition signals a fundamental shift: thermal efficiency is now a competitive variable.

Consider a manufacturing facility with $5 million in annual cooling costs. A 20% efficiency improvement saves $1 million annually—that’s money directly to the bottom line. In competitive industries with thin margins, this is the difference between profitability and losses.

FläktGroup’s integration with Samsung’s AI platforms enables:

Predictive maintenance: Instead of scheduled maintenance (replace parts every X hours), systems predict failure points before they occur. This reduces unexpected downtime from 2-3 incidents annually to near-zero.

Cross-facility optimization: A company with multiple manufacturing locations can now optimize thermal loads across the entire portfolio. During peak summer, shifting certain processes to facilities with better natural cooling is now automatically managed.

Just-in-time thermal capacity: Rather than building HVAC systems for peak demand (which occurs maybe 5% of the time), AI-optimized systems maintain lean baseline capacity and scale up on-demand. This reduces capital investment while maintaining reliability.

Supply Chain Resilience Through Distributed Intelligence

COVID-19 exposed a critical vulnerability: centralized production. When one facility went down, entire supply chains collapsed.

Smart thermal management addresses this differently than most assume. It’s not just about individual facility efficiency—it’s about enabling distributed manufacturing networks:

- Modular facility design: Smaller, regionally distributed manufacturing facilities with AI-optimized HVAC systems can operate more efficiently than massive central facilities

- Redundancy by design: Multiple smaller facilities with integrated thermal systems create built-in redundancy. If one goes down, others automatically absorb the load

- Regional customization: Local HVAC optimization means facilities can serve regional markets with shorter supply chains, reducing logistics costs and environmental impact

Samsung’s acquisition positions it as the technological enabler of this shift toward resilient, distributed manufacturing networks.

Sustainability: The Unspoken Environmental Revolution

This is where the acquisition becomes genuinely consequential beyond business strategy.

The HVAC Carbon Crisis Nobody Discusses

Buildings account for approximately 30% of global energy consumption and 25-30% of energy-related CO2 emissions. HVAC systems represent about 40-50% of building energy use. The math is stark:

HVAC systems are responsible for roughly 7-8% of global carbon emissions.

Traditional HVAC systems optimize for comfort and cost, not emissions. A system running at 60% efficiency is considered acceptable. This means 40% of energy input is wasted as heat loss, motor inefficiency, and control system leakage.

Samsung’s AI-integrated systems can operate at 75-85% efficiency, potentially reducing this waste by 50%.

What This Means at Scale

If every industrial HVAC system globally operated at 85% efficiency instead of 60%, the reduction in annual carbon emissions would equal:

- Taking 50-75 million cars off the road for a year

- The annual energy production of 15-20 large nuclear power plants

- Enough carbon reduction to offset the annual emissions of a small country

This isn’t hypothetical. FläktGroup’s existing customers have already documented 15-25% energy savings through advanced system integration. Samsung’s addition of AI optimization can push this to 30-40%.

Regulatory Tailwinds Creating Market Advantage

Governments globally are tightening building energy codes:

EU Energy Related Products Directive (ErP): Mandates minimum efficiency standards; non-compliant products face market bans

China’s Top 10,000 Enterprises Program: Requires major industrial facilities to reduce energy intensity by specific percentages

US State-Level Standards: California’s Title 24, New York’s Energy Conservation Code, and similar regulations in 20+ other states set increasingly stringent requirements

Corporate ESG Requirements: Companies like Microsoft, Google, and Amazon have committed to carbon-neutral operations, creating massive demand for ultra-efficient systems

Samsung’s position: By owning FläktGroup and integrating it with AI platforms, Samsung now offers compliance solutions that exceed minimum requirements—and save money while doing so. This creates a powerful competitive advantage in regulated markets.

Companies facing regulatory compliance don’t just want to meet standards—they want solutions that exceed them while reducing costs. Samsung now provides exactly this.

Sustainability Beyond Energy: Water, Materials, and Circularity

Water Usage in Cooling Systems

Many industrial HVAC systems rely on water-cooled condensers. In regions facing water scarcity, this is becoming a critical constraint. Traditional systems might require 1-2 gallons of water per cooling ton-hour.

AI-optimized systems can:

Predict and prevent cooling tower fouling, maintaining efficiency without excessive water bleed-off

Adjust cooling tower fan speeds to minimize water evaporation while maintaining temperature targets

Integrate weather forecasting to use cooler nighttime air when available, reducing water-dependent cooling

For a large data center in the American Southwest or Middle East, reducing water usage by 30-40% is increasingly central to operational licenses. Samsung now offers this capability.

Material Efficiency and Circular Economy Integration

FläktGroup operates more than 10 production facilities globally. This creates opportunities for:

Distributed production reducing logistics emissions: Rather than shipping finished HVAC systems across continents, regional facilities manufacture locally, reducing transportation carbon

Modular design enabling upgrades instead of replacement: Traditional HVAC systems last 15-20 years then become waste. AI-enabled modular systems can be upgraded incrementally, extending service life to 25-30 years

Recovered heat utilization: Advanced systems capture waste heat from industrial processes and cooling systems, repurposing it for facility heating, hot water, or even power generation

The Regulatory and Compliance Landscape

How FläktGroup Acquisition Strengthens Samsung’s Position

Europe (largest market for FläktGroup):

The EU has committed to climate neutrality by 2050 and intermediate targets of 55% emissions reduction by 2030. This drives aggressive energy efficiency standards. FläktGroup’s existing compliance infrastructure and customer relationships in Europe position Samsung perfectly to serve this market.

FläktGroup customers include facilities already operating under the EU Emissions Trading System (ETS)—a carbon price mechanism that makes energy efficiency financially rewarding. Samsung can now offer these customers solutions that reduce their ETS costs directly.

North America (growth market):

The Inflation Reduction Act allocates $369 billion for climate and clean energy investments. Much of this targets industrial facility upgrades. Building owners investing in efficiency improvements get tax credits—making Samsung’s premium, efficient systems more attractive.

FläktGroup’s existing North America data center team understands these incentive structures. Combined with Samsung’s capital and technology, they can help customers navigate rebate programs, tax credits, and financing options.

Asia Pacific (highest growth):

China’s carbon market reached $10 billion in value in 2023 and continues expanding. Manufacturing facilities face either carbon pricing or efficiency improvements. FläktGroup’s Singapore-based global account team can position Samsung solutions as the mechanism for compliance.

India’s Perform, Achieve and Trade (PAT) scheme requires large industrial facilities to achieve energy efficiency targets. Same dynamic—compliance creates market opportunity for Samsung.

The Supply Chain Ecosystem: How Manufacturers, Logistics, and Suppliers Realign

Upstream Integration Opportunities

By acquiring FläktGroup, Samsung now controls thermal infrastructure but doesn’t necessarily control all components:

Compressors: Currently sourced from Copeland, Emerson, Danfoss, and others

Refrigerants: Supplied by Chemours, Honeywell, Orbia

Controls and sensors: Mixed sourcing from Siemens, Honeywell, Johnson Controls

Materials: Copper, aluminum, steel from commodity suppliers

The opportunity: Samsung can work upstream with these suppliers to:

Develop integrated components: Rather than buying separate compressors and control systems, Samsung can collaborate on compressor-control systems optimized for AI-enabled predictive operation

Refrigerant innovation: Current refrigerants face environmental regulations. Samsung can fund development of next-generation, more efficient refrigerants specifically optimized for smart thermal systems

Material optimization: AI-powered systems require different thermal dynamics than traditional systems. This enables material science innovation—lighter, more efficient heat exchangers, better insulation materials, optimized copper geometries

Sensor ecosystem: FläktGroup’s facilities will need millions of sensors. This creates opportunity for Samsung’s semiconductor division to develop custom sensors for thermal applications

Downstream Integration: The Service Economy

FläktGroup maintains extensive service networks. This represents enormous data:

Millions of system performance data points from facilities across multiple continents

Predictive patterns about failure modes, efficiency degradation, and seasonal variations

Customer behavior data about operational patterns and preferences

Samsung now controls this data. Combined with AI analysis, this enables:

Predictive service models: Rather than scheduled maintenance or reactive repair, Samsung can offer condition-based service—only sending technicians when systems genuinely need it

Extended warranty programs: With superior predictive accuracy, Samsung can offer longer warranties at lower cost than competitors, creating customer lock-in

Retrofit opportunities: Analyzing performance data across the installed base reveals which older systems could benefit from modernization, creating sales pipeline

The service economy around HVAC—currently fragmented across thousands of local contractors—becomes increasingly centralized and data-driven. Samsung now owns the platform.

Cross-Industry Impact: Beyond Data Centers

Healthcare Infrastructure Modernization

Hospitals require HVAC reliability comparable to life support systems. System failures literally endanger lives.

Post-pandemic, hospitals globally are upgrading HVAC systems to meet advanced air quality standards, contamination separation, and redundancy. This is driving approximately $20-30 billion in annual spending globally.

FläktGroup already serves hospitals. Samsung’s addition of AI-enabled predictive maintenance and optimization creates compelling value:

- Risk reduction: Hospitals can reduce HVAC-related downtime to near-zero through predictive intervention

- Operational flexibility: Smart systems enable reconfiguration of floor space for different departments without redesign

- Cost management: Energy efficiency reduces hospital operating costs—significant for margin-constrained healthcare providers

- Regulatory compliance: Meeting increasingly stringent air quality regulations becomes systematic rather than reactive

Pharmaceutical and Biotech Manufacturing

The biopharmaceutical industry is experiencing explosive growth—mRNA vaccines, monoclonal antibodies, advanced therapies. Every facility requires precision HVAC.

FläktGroup serves this market. Samsung’s AI integration enables:

Hyper-precision temperature control: ±0.1°C accuracy becomes standard, enabling new manufacturing techniques

Batch traceability: Thermal data integrates with manufacturing records, enabling precise correlation between environmental conditions and product quality

Scalability: Companies can deploy identical production lines in different geographies with confidence that thermal performance will be identical

Regulatory documentation: Automated thermal monitoring and documentation simplifies FDA and EMA compliance

For a pharmaceutical company manufacturing $500 million in annual product, a 1% improvement in yield from better thermal control generates $5 million in additional profit.

Data Center Evolution

This is the public story but worth exploring deeper:

Current data center growth trajectories are unsustainable without thermal innovation. Server density continues increasing—hyperscalers are testing systems with 50+ kilowatts per rack (versus 5-10 kilowatts in traditional data centers).

Traditional cooling approaches simply cannot handle this density cost-effectively. Liquid cooling becomes necessary, but current liquid cooling systems:

Require extensive plumbing infrastructure

Face corrosion and maintenance challenges

Demand highly specialized technicians

Create single points of failure

FläktGroup’s advanced systems combined with Samsung’s AI enable:

Predictive liquid cooling: AI anticipates thermal loads and pre-positions cooling fluid circulation patterns

Distributed redundancy: Multiple smaller cooling systems provide backup to prevent failures

Cross-facility optimization: AI can intelligently distribute compute workloads based on thermal capacity across multiple data centers

This enables hyperscalers to operate at higher densities with lower operational risk—directly impacting their profitability and ability to scale.

Competitive Dynamics: Why This Matters for Industry Structure

The Consolidation Imperative

HVAC has historically been fragmented. Hundreds of regional players, thousands of local installers. Low barriers to entry, moderate differentiation.

Samsung’s acquisition of FläktGroup signals that this era is ending. The next phase requires:

Global scale to serve multinational customers

AI capability integrated with thermal systems

Data infrastructure to capture and analyze performance

Capital to fund R&D and geographic expansion

Integration with broader building/manufacturing platforms

Few companies have all five. This creates consolidation opportunity.

Likely responses from competitors:

Johnson Controls, Honeywell, Siemens: Will accelerate acquisition of regional HVAC players or invest heavily in proprietary AI platforms

Emerson Electric, Carrier, Trane: May pursue partnerships or acquisitions to compete on AI-integrated systems

Startups: Will focus on niche applications (automotive thermal management, aircraft cabin systems, specialized industrial processes) where they can differentiate

The industry structure is shifting from fragmented commodity providers to integrated platform companies. Samsung’s move validates and accelerates this shift.

Geopolitical and Supply Chain Security Implications

Strategic Autonomy Through Infrastructure Control

HVAC infrastructure is increasingly recognized as strategic. During the global semiconductor shortage of 2021-2022, the ability to maintain data center operations became a geopolitical issue. Countries competing for AI leadership realized that thermal infrastructure underpins computational capacity.

Samsung’s acquisition of FläktGroup strengthens South Korea’s position:

Technology control: A Korean company now controls advanced thermal technology serving global data center operators

Supply chain security: Samsung ensures access to advanced cooling systems for South Korea’s own data centers and manufacturers

Global influence: The ability to provide or restrict advanced thermal systems gives Samsung (and by extension, South Korea) subtle geopolitical leverage

This mirrors how chip manufacturing dominance gave Taiwan and South Korea geopolitical importance. Thermal infrastructure may become similarly significant.

Regional Manufacturing Resilience

By maintaining FläktGroup’s regional manufacturing bases and expanding them, Samsung enables different regions to build resilient manufacturing capacity:

Europe: Can maintain high-efficiency manufacturing without dependence on Asian suppliers

North America: Can scale AI-enabled manufacturing within USMCA, strengthening North American competitiveness

Asia: Can expand advanced manufacturing capacity with locally-optimized thermal systems

The Investor and Stakeholder Perspective

What This Acquisition Signals About Samsung’s Strategy

For Samsung investors, this acquisition reveals:

Diversification into infrastructure: Massive data center build-out globally creates sustainable demand for advanced HVAC, less vulnerable to product cycles than consumer electronics

Asset-light through partnerships: By acquiring operational assets (FläktGroup) rather than building from scratch, Samsung accelerates time-to-market and inherits customer relationships

Integration as competitive strategy: Rather than competing on hardware alone, Samsung competes through ecosystem integration—HVAC systems that work seamlessly with building management, IoT, and data center operations

Long-term positioning: This isn’t optimized for Q2-Q3 earnings. It’s positioned for 2030-2040 when thermal infrastructure becomes as important as compute infrastructure

What This Signals About Global Industrial Trends

For manufacturers globally, the FläktGroup acquisition signals:

AI integration is inevitable: Companies that don’t integrate AI into operational systems will lose competitive advantage

Energy efficiency is profitable: Rather than viewing efficiency as a cost, forward-looking companies see it as margin improvement

Ecosystem lock-in is real: Integrating with platforms (Samsung, Microsoft Azure, Google Cloud) creates switching costs and long-term relationships

Infrastructure companies win: In commodity markets, infrastructure plays often outperform pure technology plays

Future Implications: What Changes in 3-5 Years

Thermal Management Becomes Visible

Currently, HVAC is invisible—you notice it only when it fails. In 3-5 years:

Building dashboards will display thermal efficiency as prominently as energy consumption

Thermal optimization will become a metric in corporate ESG reporting

Facility managers will be evaluated partly on thermal system performance

Real estate valuations will incorporate thermal infrastructure quality

Predictive Maintenance Becomes Standard

Current state: System breaks, technician fixes it. Future state: System predicts failure 2 weeks in advance, automatically orders parts, schedules maintenance at optimal time.

This transformation happens across industrial equipment but accelerates in HVAC because:

Systems generate vast amounts of sensor data (thousands of data points per facility)

Failure is costly and dangerous, making prediction high-value

AI integration becomes economically justified quickly

Distributed Manufacturing Accelerates

With thermal systems becoming intelligent, predictable, and efficient, distributed regional manufacturing becomes more viable than centralized mega-facilities. Supply chain resilience becomes competitive advantage.

Companies will increasingly deploy manufacturing capacity regionally, supported by Samsung’s distributed HVAC infrastructure.

Water Efficiency Becomes Regulatory Mandate

Water scarcity is intensifying globally. Industrial HVAC systems consume enormous amounts. Regulations will increasingly mandate water-efficient cooling—driving adoption of advanced systems.

FläktGroup’s expertise in cooling tower optimization positions Samsung well for this transition.

What The Acquisition Means For Different Stakeholders

Facility Managers: From cost-cutting to strategic optimization. Your thermal systems now compete on intelligence and integration, not just capacity and efficiency.

Energy Providers: From commodity electricity to strategic infrastructure partnership. Smart HVAC systems that integrate with grid management become valuable partners, not just customers.

Industrial Manufacturers: From paying for cooling to leveraging cooling as competitive advantage. Energy efficiency translates to cost advantage, enabling margin improvement or price competition.

Environmental Regulators: From setting standards to having technology partners enable compliance. Samsung now has incentive to help facilities exceed regulatory requirements.

Data Center Operators: From managing thermal risk to leveraging thermal intelligence. Systems that predict and prevent failures enable higher utilization and lower operating costs.

Governments: From subsidizing efficiency to enabling market-driven adoption. When efficiency creates profit, subsidies become unnecessary.

Frequently Asked Questions: The Real Story

Q: Is this just about cooling data centers? A: No. FläktGroup serves hospitals, pharmaceutical facilities, commercial complexes, industrial manufacturers, and marine operations. The data center focus is the highest-growth segment, but the real value is breadth across industries demanding precision environmental control. Every vertical benefits from intelligent thermal management.

Q: How does this compete with traditional HVAC companies? A: It doesn’t compete in the old way. Traditional HVAC companies sell products. Samsung is building an ecosystem where HVAC becomes integrated intelligence infrastructure. That’s a different category. Companies like Carrier and Trane are competitors, but they’re playing yesterday’s game. Samsung is playing tomorrow’s game.

Q: What’s the timeline for seeing real returns? A: FläktGroup maintains independent operations under Samsung’s oversight, preserving institutional knowledge. Financial synergies emerge within 12-18 months (operational efficiencies, cross-selling). Technology integration (AI-optimized controls) within 24-30 months. Market impact (industry-wide adoption of intelligent systems) within 36-48 months. Long-term returns span decades.

Q: Can competitors replicate this strategy? A: They can acquire HVAC companies. They cannot acquire FläktGroup’s specific global positioning, relationships with hyperscale providers, technical heritage, and regional manufacturing bases. First-mover advantage in infrastructure is substantial and durable.

Q: How does this help Samsung’s consumer business? A: Indirectly but significantly. Buildings upgraded with Samsung’s smart HVAC systems naturally adopt Samsung’s broader IoT ecosystem—SmartThings for residential spaces, b.IoT for commercial. Infrastructure plays drive consumer adoption through ecosystem lock-in.

Q: What’s the real environmental impact? A: If deployed at scale globally, intelligent HVAC systems could reduce industrial and commercial building energy consumption by 20-30%. This translates to 2-3 billion tons of CO2 reduction annually by 2035—equivalent to removing 400-600 million cars from roads or replacing 20-30 large coal plants with renewables. This isn’t theoretical—it’s achievable within 10 years.

Q: Is this the end of FläktGroup as an independent brand? A: No. Samsung explicitly maintains FläktGroup’s name, management, personnel, and facilities as an independent subsidiary. This preserves technological expertise, customer relationships, and institutional knowledge that would be lost through integration.

Q: How does Samsung’s vertical integration benefit customers? A: Customers historically bought HVAC from one vendor, building management systems from another, IoT platforms from a third. These systems rarely communicated effectively. Now, customers can deploy integrated thermal + building management + IoT infrastructure from a single vendor with unified engineering, support, and optimization. This reduces complexity, improves reliability, and enables optimization impossible with disconnected systems.

Q: What about regional differences in HVAC requirements? A: Thermal infrastructure varies dramatically by climate. Tropical Asia requires different approaches than temperate Europe or arid Middle East. FläktGroup’s regional operations enable customization. Samsung’s AI platforms enable learning across regions—what works in one climate informs optimization in another. This is competitive advantage traditional regional players cannot match.

Q: Will HVAC costs increase for consumers? A: Premium, intelligent systems cost more upfront but save substantially through reduced energy consumption, lower maintenance, and extended service life. For cost-conscious buyers, traditional systems remain available. For strategic users (hyperscalers, manufacturers, hospitals), the ROI on intelligent systems is typically 3-5 years. After that, it’s pure savings.

Q: How does this impact developing economies? A: Developing markets face explosive growth in data center demand. They cannot afford inefficient thermal infrastructure that wastes energy and requires constant maintenance. Samsung’s offering enables emerging markets to build efficient infrastructure from the start, avoiding the capital inefficiency of older systems. This accelerates adoption of advanced systems in Asia, Africa, and Latin America.

Q: What’s the role of open standards versus proprietary integration? A: Samsung emphasizes integration but works within industry standards (ASHRAE, ISO, EU regulations). This enables interoperability while ensuring Samsung systems work optimally together. It’s the Microsoft playbook—embrace standards while making proprietary integration compelling enough that customers want it.

Infrastructure Wins Are Silent But Decisive

The most powerful strategic moves often happen in industries nobody watches. Everyone tracked Apple’s move into services, Amazon’s expansion into healthcare, Microsoft’s AI integration. Few noticed Samsung quietly securing the thermal infrastructure backbone of tomorrow’s technology stack.

FläktGroup’s acquisition reveals a truth about competitive advantage in 2025: The glamorous battlefields get crowded and commoditized. The unglamorous battlefields get won and owned.

When everyone else is arguing about AI models and processing speeds, Samsung is engineering the climate in which those models can actually exist. When competitors focus on the next processor generation, Samsung controls the infrastructure ensuring that processor can operate at peak efficiency without overheating, without wasting electricity, without failure.

In the 1980s-1990s, vertically integrated companies lost to platform specialists. Microsoft beat IBM not through better hardware but through controlling the software layer.

In the 2010s-2020s, platform specialists lost to ecosystem integrators. Apple didn’t just build phones—it built ecosystems where devices, software, and services reinforce each other.

In the 2020s-2030s, ecosystem integrators will be beaten by infrastructure integrators—companies that control the invisible layers underpinning all others.

Samsung just made a clear statement about which camp it intends to join.

The Pharmaceutical Manufacturing Revolution Through Thermal Control

Pharmaceutical manufacturing represents one of the most thermally-demanding industrial processes globally. A single modern biopharmaceutical facility can cost $500 million to $1 billion to construct and operate. Thermal precision isn’t optional—it determines product quality, yield, and regulatory compliance.

The Challenge: mRNA vaccine production requires maintaining temperatures within ±0.5°C across massive clean rooms. Monoclonal antibody production demands similar precision. When temperature deviates even 1°C from specification, entire batches—worth millions of dollars—must be discarded as non-compliant.

Traditional HVAC approaches treat this as an engineering problem: build systems with redundant capacity and hope they work. FläktGroup’s approach treats it as an optimization problem: predict thermal demands, adjust capacity preemptively, and provide data-driven confidence that specifications will be met.

With Samsung’s AI integration, this becomes transformative:

Batch-specific optimization: AI learns that a particular production formula generates specific thermal signatures. When that formula runs, systems pre-position cooling capacity based on historical patterns

Yield correlation: Thermal data feeds into manufacturing data systems, enabling precise correlation between environmental conditions and product quality—unlocking opportunities to improve yield through environmental optimization

Regulatory documentation: Automated thermal monitoring creates comprehensive compliance documentation, reducing the burden of manual temperature logging and reducing human error

Cross-facility consistency: A pharmaceutical company manufacturing in Europe, North America, and Asia can now ensure identical environmental conditions across all facilities, enabling consistent product quality globally

Economic impact: For a facility producing $500 million in annual product, a 1% yield improvement from better thermal control generates $5 million in additional profit. This ROI justifies premium pricing for intelligent systems and creates customer lock-in.

Semiconductor Manufacturing: Where Thermal Precision Enables Process Innovation

Modern semiconductor fabrication occurs at progressively smaller geometries (currently 3nm, approaching 2nm). At these scales, thermal management isn’t a constraint—it’s the primary enabler or blocker of production capacity.

A single advanced semiconductor fab costs $15-20 billion and represents cutting-edge technology. These facilities require:

Class 1 clean rooms with temperature precision ±0.5°C

Process tool temperature stability within ±0.1°C

Humidity control within ±5% relative humidity

Vibration isolation to prevent equipment interference

Contamination prevention through sophisticated air handling

Traditional HVAC systems struggle with this combination. FläktGroup’s systems, enhanced with Samsung’s AI, address each dimension:

Predictive vibration management: AI monitors vibration signatures and adjusts HVAC system operation to minimize vibration-inducing resonances

Contamination flow modeling: AI uses computational fluid dynamics to model airflow patterns and predict contamination risks before they occur

Tool-specific cooling: Different process tools generate different heat signatures. AI learns these patterns and pre-optimizes cooling for each tool type

Yield enhancement through environmental control: Companies like Samsung’s own semiconductor division can now optimize their own manufacturing—using Samsung HVAC to improve Samsung chip production

This creates interesting strategic dynamics: Samsung now controls thermal infrastructure for competitors’ semiconductor fabs globally. This gives Samsung insight into competitors’ production volumes, process types, and operational patterns. The strategic implications are profound but subtle.

Data Center Thermal Efficiency: The 40% Savings Opportunity

Current state-of-the-art data centers operate at Power Usage Effectiveness (PUE) ratios of 1.2-1.5, meaning for every watt of computing power, 0.2-0.5 watts go to cooling and auxiliary systems.

FläktGroup’s systems combined with Samsung’s AI optimization can achieve PUE ratios of 1.05-1.1, meaning nearly all energy goes to computing rather than cooling waste.

Why this matters:

A hyperscale data center consuming 50 megawatts of computing power currently requires 10-25 megawatts of cooling energy. At current electricity rates ($0.05-0.10 per kilowatt-hour), this represents $4.4-43.8 million annually in cooling costs.

A 25% improvement in cooling efficiency saves $1.1-11 million annually. Over a 30-year facility lifespan, this is $33-330 million in cumulative savings—often exceeding the total cost of the thermal management system.

The innovation pathway:

Traditional data center cooling used room-scale air handling. Current generation uses row-level cooling (hot/cold aisles). Next generation uses rack-level cooling (direct-to-chip liquid cooling). Future generation uses integrated thermal-compute optimization where cooling strategies vary millisecond-by-millisecond based on actual computational workloads.

FläktGroup’s infrastructure combined with Samsung’s workload visibility (Samsung provides chips and infrastructure) enables this future state. A compute workload can now communicate its thermal requirements to the cooling system, which dynamically adjusts to meet those requirements with minimal waste.

This is competitive advantage—hyperscalers using Samsung infrastructure can operate at lower cost-per-computation than competitors, enabling price competition or margin improvement.

Marine and Offshore Operations: Thermal Management in Extreme Environments

Large container ships, oil platforms, and offshore installations face unique thermal challenges:

Salt water corrosion: Traditional cooling infrastructure deteriorates rapidly in marine environments

Motion and vibration: Ships, platforms, and rigs move constantly, requiring robust equipment

Extreme temperatures: Arctic regions, tropical waters, and sun-exposed environments create opposing challenges

Reliability criticality: Equipment failure at sea can be catastrophic

FläktGroup has supplied marine thermal systems for decades. Samsung’s addition of AI enables:

Predictive corrosion management: AI learns corrosion rates for different alloys in different environments and schedules maintenance preemptively

Motion compensation: Systems automatically adjust for vessel motion and vibration, maintaining performance despite environmental motion

Fuel consumption optimization: Ships represent one of the largest fuel consumers globally. Optimized HVAC reduces fuel consumption, directly impacting shipping economics and environmental impact

Remote monitoring: AI monitors systems across global fleets and alerts operators to issues before they become critical, reducing unscheduled downtime

For shipping companies spending $100 million+ annually on fuel, even 5% fuel efficiency improvement saves $5 million annually. For the global shipping industry, this translates to billions in fuel savings and significant environmental impact.

The Hidden Supply Chain Multiplier Effect

Samsung’s acquisition of FläktGroup creates supply chain dynamics that ripple far beyond HVAC:

Sensor manufacturers: FläktGroup’s facilities will require millions of additional sensors (temperature, humidity, pressure, vibration). This creates opportunity for advanced sensor companies and drives innovation in sensor miniaturization and affordability.

Materials science: AI-optimized systems operate under different stress profiles than traditional systems. This drives innovation in:

Heat exchanger materials (improving thermal conductivity)

Insulation materials (reducing heat transfer losses)

Refrigerants (more environmentally friendly, higher efficiency)

Alloys and composites (lighter weight, better performance)

Electronics and controls: Advanced systems require sophisticated control electronics. This creates supply contracts worth billions for semiconductor companies, circuit board manufacturers, and industrial electronics firms.

Software and AI platforms: Samsung’s integration relies on software excellence. This drives demand for ML engineers, software architects, and cloud infrastructure. Tech talent increasingly flows to companies building intelligent infrastructure.

Service and installation networks: FläktGroup’s geographic expansion requires training and hiring thousands of technicians, installers, and field engineers. This creates employment and skill development opportunities globally.

The multiplier effect: A $10 billion HVAC acquisition drives tens of billions in downstream supply chain activity.

The Regulatory and Standards Evolution

How Samsung Influences Industry Standards

Standards typically emerge from industry consortiums (ASHRAE, ISO, IEEE) over years or decades. But dominant market players influence which standards gain traction.

Samsung, through FläktGroup, can now:

Influence cooling standards development: As a major HVAC provider globally, Samsung can propose standards that align with intelligent thermal system capabilities

Drive adoption of new metrics: Instead of just measuring efficiency (COP—Coefficient of Performance), Samsung can propose broader metrics including predictability, flexibility, and integration capability

Enable regulatory compliance at scale: Governments looking to implement new efficiency standards can rely on Samsung-provided infrastructure to achieve compliance targets

Future State (2030-2035): The Thermal Intelligence Paradigm

What The Industry Looks Like After This Acquisition Fully Matures

2026-2027 (Near-term):

Samsung integrates FläktGroup operations, launches co-branded products

First AI-enhanced HVAC systems reach market for premium data center and enterprise customers

Competitors respond with acquisitions and in-house AI development

Industry begins consolidation; smaller regional players struggle or exit

2028-2029 (Medium-term):

AI-optimized HVAC becomes industry standard rather than premium offering

Integration with building management systems becomes expected

Regulatory bodies incorporate smart thermal systems into compliance requirements

Pharmaceutical and semiconductor companies universally adopt intelligent thermal management

Second wave of consolidation; remaining independent regional players are acquired or specialized

2030-2035 (Long-term):

HVAC systems compete primarily on intelligence, efficiency, and integration rather than capacity or cost

Thermal infrastructure becomes foundational layer in every data center, pharmaceutical facility, semiconductor fab, and large building

Energy efficiency improves 30-40% across industrial/commercial buildings

Water usage for cooling drops 20-30% in water-stressed regions

Carbon emissions from HVAC systems decline 40-50% through efficiency and smart operation

Service economy completely transforms from reactive repair to predictive management

New applications emerge (thermal energy storage, waste heat recovery, building-to-grid integration) driven by intelligent systems

Why This Matters More Than You Think

For Enterprise IT Leaders: Your thermal infrastructure is now a strategic decision, not just a facilities decision. Modern AI-integrated systems can reduce your energy costs by 20-30%, improve reliability through predictive maintenance, and integrate seamlessly with your broader IoT ecosystem. Budget for thermal infrastructure upgrades over the next 2-3 years.

For Facility Managers: Your role is evolving from cost management to performance optimization. The thermal systems you deploy today determine your operational flexibility for the next 20 years. Invest in intelligent systems that can adapt to future workload changes rather than static systems optimized for current capacity.

For Industrial Manufacturers: Thermal efficiency directly impacts your competitive position. A 15% reduction in energy consumption for an industrial facility adds directly to profit margins. This justifies investment in advanced systems and creates a moat against competitors who haven’t modernized.

For Data Center Operators: Thermal infrastructure cost is significant—potentially 20-30% of total operating costs. Moving from a cost center to an efficiency center through AI optimization is the low-hanging fruit for margin improvement. Evaluate next-generation thermal systems seriously.

For Investors: Infrastructure companies with strong competitive positions (like Samsung post-FläktGroup) outperform over 10+ year horizons. They create dependence. They generate recurring revenue through service and optimization. They face lower commoditization risk than consumer product companies. Watch for similar consolidation in other infrastructure layers.

For Governments: Your energy efficiency targets are achievable with proper infrastructure deployment. Partner with leaders like Samsung to accelerate building stock modernization. The productivity gains and carbon reduction justify public-private partnerships and incentive programs.

For Environmental Advocates: The most impactful climate action often happens in unglamorous infrastructure layers, not in visible consumer choices. Supporting infrastructure modernization (thermal systems, industrial efficiency, supply chain optimization) creates far larger carbon reductions than consumer behavior change alone.

The Unsexy Revolution

Revolutions in technology rarely look revolutionary in real-time.

Steam engine adoption seemed mundane—just a way to pump water out of mines more reliably. Until suddenly the entire industrial system reorganized around it.

Electricity felt like a luxury upgrade to gas lighting. Until the entire economy became dependent on it.

The internet seemed like a messaging tool for academics. Until the entire global commerce system rebuilt around it.

Thermal infrastructure integration with AI seems like a boring efficiency play.

Until, gradually, every strategic decision becomes dependent on it. Until controlling thermal infrastructure means controlling the foundation upon which everything else operates. Until companies that own it shape the future, and companies that don’t adapt to its constraints.

Samsung just made a quiet move into unsexy infrastructure.

This move will shape the next decade of global competition far more than flashy AI breakthroughs or revolutionary chip designs.

That’s why it matters.